Menu

| Processors | > | Percentage Rent Reconciliation |

Mandatory Prerequisites

Prior to running the Percentage Rent Reconciliation Process, refer to the following Topics:

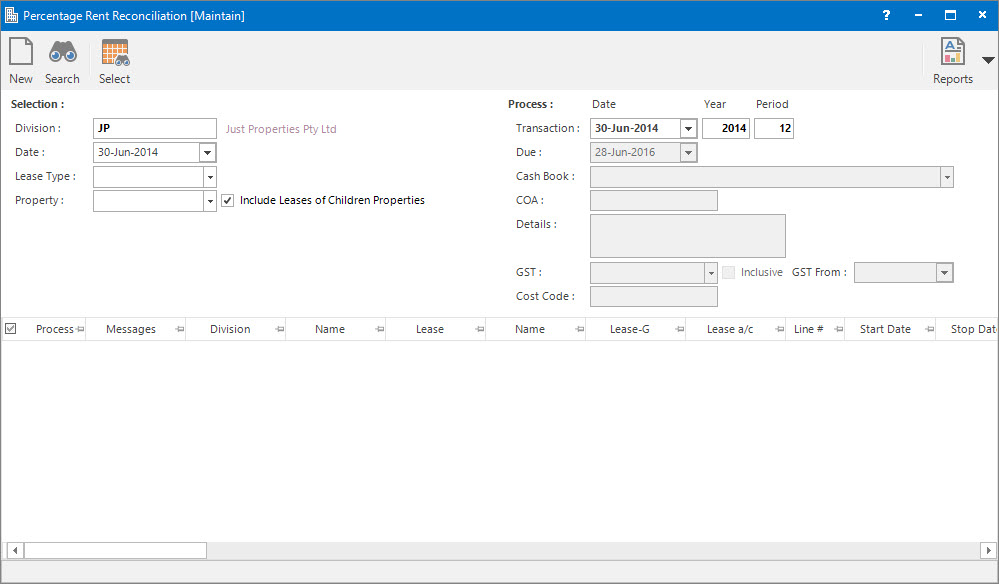

Screenshot and Field Descriptions

Selection

Division: this is the division to run the Percentage Rent Reconciliation process for. It will default to the division that the user is logged onto.

Date: this is the date to reconcile the percentage rent up to.

Lease Type: this is a selection filter value for the type of Lease (Tenant / Landlord).

Property: this is a drop down list of the Property / Lease entities that the selection can be filtered on. Select a value from the drop down list and the appropriate filter field will be displayed.

Include Leases of Children Properties: this is a selection filter value to include leases attached to children properties of the Property being used as a filter. If a Building is being filtered on it works as follows:

- If checked, leases for the Sections, Suites and Annexes attached to the Building will be shown.

- If not checked, only leases directly attached to the Building level will be shown.

Process

Transaction (Date / Year / Period): this is the Date and Accounting Period values that the reconciliation transactions will be assigned when created.

Due Date: this is the Due Date for the reconciliation transactions created. It is used for credit control and ageing analysis in reports such as the Aged Trial Balance.

Cash Book: this is the Bank account if the reconciliation transactions raised are going to be a Cash Sales / Cash Credit type transaction. Leave blank if a Invoice / Credit Note type transaction is to be raised.

COA: this is the Chart of Account for the reconciliation transactions raised.

Details: this is the description for the reconciliation transactions. It will default to the value set up for the COA.

GST: this is the GST Type for the reconciliation transactions. It will default to the type set up for the COA.

Inclusive: this check box determines if the reconciliation Amount includes GST. If this field is ticked, when the GST is calculated, the Amount will be reduced by the GST and the tick will disappear to reflect that the line no longer includes GST. If this check box is not ticked, the reconciliation Amount will not be reduced and the GST will be calculated normally.

GST From: this is a historical field and current use is now irrelevant. It was used during the implementation of GST to allow contractual date based transactions to escape full GST. There may be old transactions on the system to which the rule applied.

Cost Code: this is the cost centre that the reconciliation amounts relate to. This field can be set as optional, mandatory or not required on the COA set up screen.

Reconciliation table: this is populated with the Percentage Rent Charges to be reconciled when the Application tool-bar push button: Select is clicked.

How Do I : Run the Percentage Rent Reconciliation process

If a Percentage Rent Reconciliation report is already held in the system (from a previous run) the Application tool-bar push button: X Report will appear. Click the button to reset the pending report so a new reconciliation process can be run.

The Percentage Rent Reconciliation report is only temporary. It will be overwritten when the next reconciliation process is run.

The Percentage Rent Reconciliation Process is associated with the following Topics: